Planning for 2024: An Exercise in Futility

We borrowed an adage from Dwight D. Eisenhower to explain the financial planning and investment philosophies we expected to pursue when we launched Solyco Wealth:

We borrowed an adage from Dwight D. Eisenhower to explain the financial planning and investment philosophies we expected to pursue when we launched Solyco Wealth:

In preparing for battle I have always found that plans are useless, but planning is indispensable.

Indubitably, the behaviors of financial markets in 2023 proved our adoption of Ike’s approach prescient. Before advancing our plans for next year, we think it a good idea to perform a quick review of actions this year.

Along with much of the rest of the investment community, we expected a recession in 2023, if only a mild one. Instead, US economic growth roared higher, thumbing its nose at the Fed and its interest rate hikes as domestic consumers spent the funds pandemic support programs placed in their pockets. Shame on us for anticipating that savings rates would remain abnormally high as consumers exercised a degree of caution exiting the upheaval of 2020 to 2022. Silly us!

Our investment planning process, however, shielded us from much of the destruction wrought on bond markets by higher interest rates. We also relied heavily on our stock-picking acumen and sell discipline to post very attractive returns, not only relatively but also absolutely, despite remaining underweight the Technology sector year-to-date. Recently, we executed much of our tax-loss selling program for 2023 which not only allowed us to benefit clients by reducing their prospective tax bills but also forced us to re-evaluate our investment thesis for lagging sectors like Materials and Healthcare.

So, with these quick 2023 observations, on to views for 2024! Underpinning our approach to investing in 2024 are the following expectations:

- The US Federal Reserve Bank executed its last increase for this cycle.

- Inflation trends lower but fails to approach the Fed’s 2% target as housing expenses stay elevated and oil prices exhibit ongoing volatility.

- Interest rates, thus, will remain higher for longer than many investors forecast constraining credit formation.

- Domestic employment will remain robust with only very modest increases in the unemployment rate.

- As a result of only a normalizing unemployment rate, economic growth remains positive albeit slowing substantially from 3Q23’s 4.9% annualized growth rate.

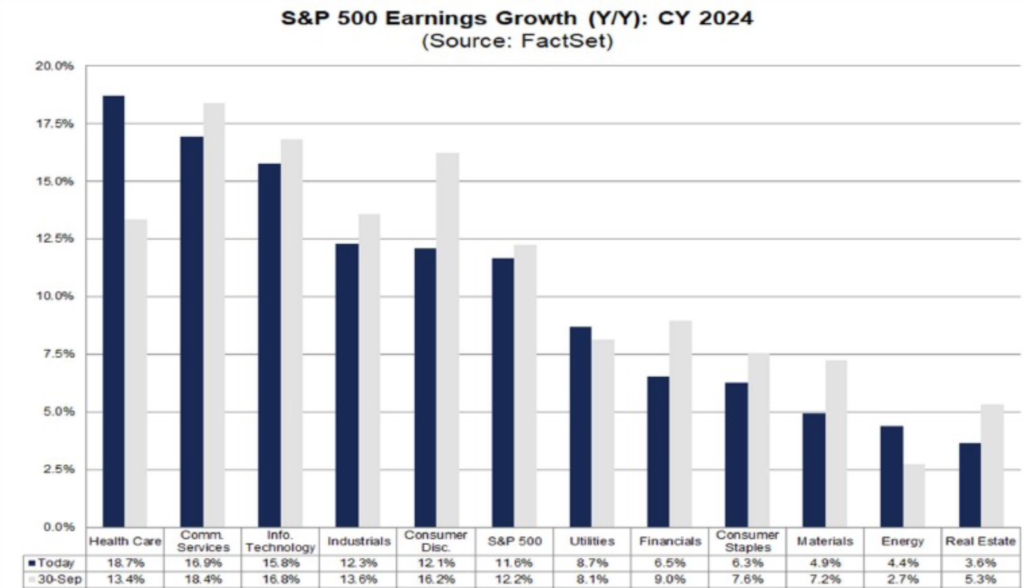

- Foregoing a recession, earnings growth in 2024 amounts to ~10% (see graphic from FactSet below).

- Investment grade and government debt provide positive total returns next year with high-yield spreads widening amidst increasing default rates and tightening credit conditions.

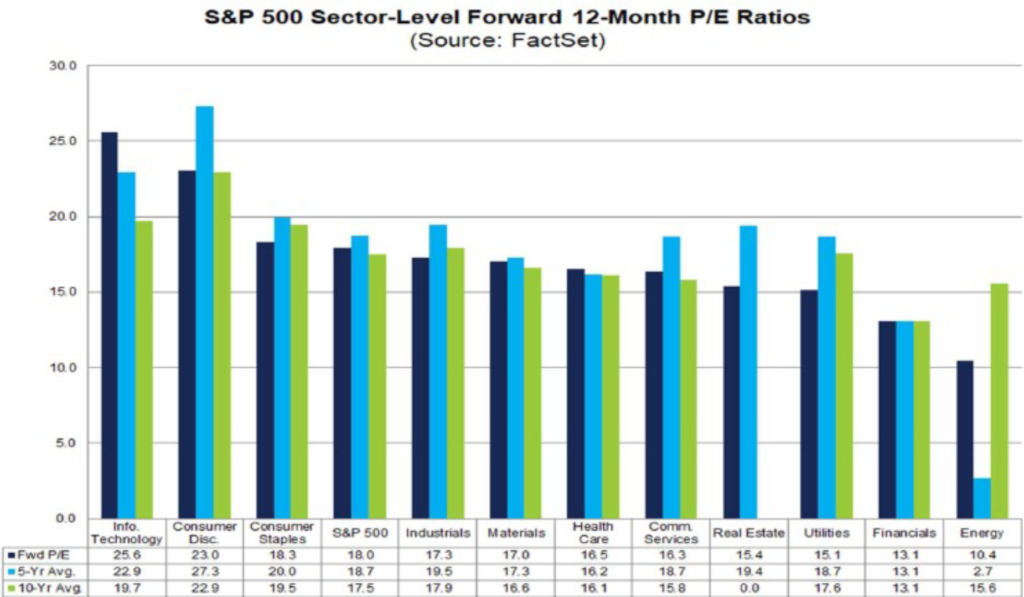

- Major equity indices generate high single-digit returns in response to solid earnings growth, increased breadth as compared to this year’s 2023 Tech-dominated run higher, and not exorbitant price-to-earnings multiples (see FactSet chart below).

- Major equity indices generate high single-digit returns in response to solid earnings growth, increased breadth as compared to this year’s 2023 Tech-dominated run higher, and not exorbitant price-to-earnings multiples (see FactSet chart below).

Based on the above expectations, we expect to overweight the Consumer Staples and Industrials sectors vis-à-vis our Russell 3000 benchmark while underweighting Technology, according to the following table. Previously, our model and client portfolios carried overweights to the Materials and Industrials sectors while being underweight Financials and Technology.

With respect to our positioning on Fixed Income, we remain short duration as compared to the benchmark US Bloomberg Aggregate Bond Index. While we find long-dated US Treasuries intriguing at recent levels, we see little reason to endure the volatility of long-dated bonds in light of the relatively very flat yield curve. We continue to prefer getting paid to wait in short-term positions and equities with the prospects of duration out-performance likely linked only to the Fed choosing to cut rates, a phenomenon we see possibly occurring some time late in 2024, if then.

As we learned on 2023, geopolitical events create substantial risks to the best thought-out economic forecasts and investment plans. The increasingly interlinked nature of these risks – restrictive China trade policy limiting the international flow of dollars that, in turn, reduces world demand for US Treasuries at a time of substantial required new issuances, for example – argue for research-rich, risk averse, and active management approach to investing.