Outperforming in 4Q23 Likely Will Require Getting Out of 1H23’s Comfort Zone

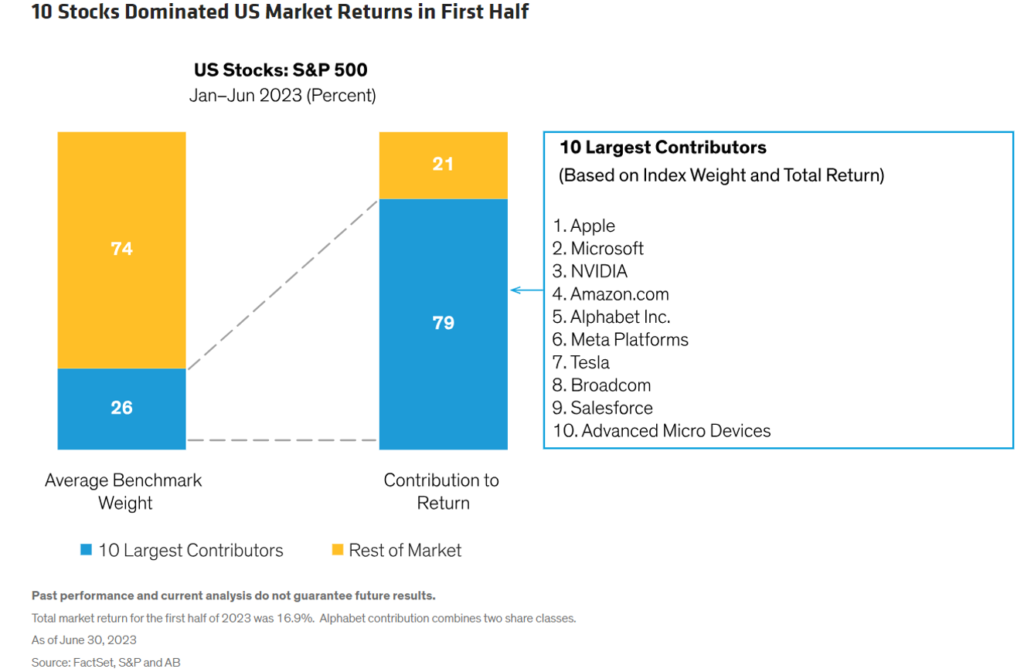

It’s no secret to active investors that the 10 largest US stocks dominated market returns in 1H23. The following chart provided by AllianceBernstein with data assists from FactSet and Standard & Poor’s, details exactly to what degree these 10 companies drove the S&P 500’s 16.9% 1H23 total return. Notably, six of the 10 are Tech stocks while Amazon and Tesla fall into Consumer Discretionary and Alphabet and Meta reside in the Communication Services sector. Outperformance in 4Q23 and in 2024 probably will require investors to add some breadth to their holdings beyond these companies and sectors, possibly well beyond them.

It’s no secret to active investors that the 10 largest US stocks dominated market returns in 1H23. The following chart provided by AllianceBernstein with data assists from FactSet and Standard & Poor’s, details exactly to what degree these 10 companies drove the S&P 500’s 16.9% 1H23 total return. Notably, six of the 10 are Tech stocks while Amazon and Tesla fall into Consumer Discretionary and Alphabet and Meta reside in the Communication Services sector. Outperformance in 4Q23 and in 2024 probably will require investors to add some breadth to their holdings beyond these companies and sectors, possibly well beyond them.

Predictably, in our view, equity market behavior in 3Q23 largely follows a consolidation pattern consistent with investors – including us – processing disparate data on:

|

|

Money flows thus far in 3Q23, though, convinced us of one thing: the same 10 stocks will not lead equity markets in 2H23 that drove performance in the first half of this year. For the balance of this year, we anticipate significant broadening of equity market positive performance. Such action would be part and parcel with our expectation for 2024 evolving into a stockpicker’s market vis-à-vis the substantially limited momentum-based drivers that defined 1H23. The value propositions, as reflected by price-to-earnings ratios, along with post-2Q23 earnings season trading patterns support this view. For instance as conveyed in the following graph, small caps over the past 50 years rarely traded as inexpensively as they recently traded.

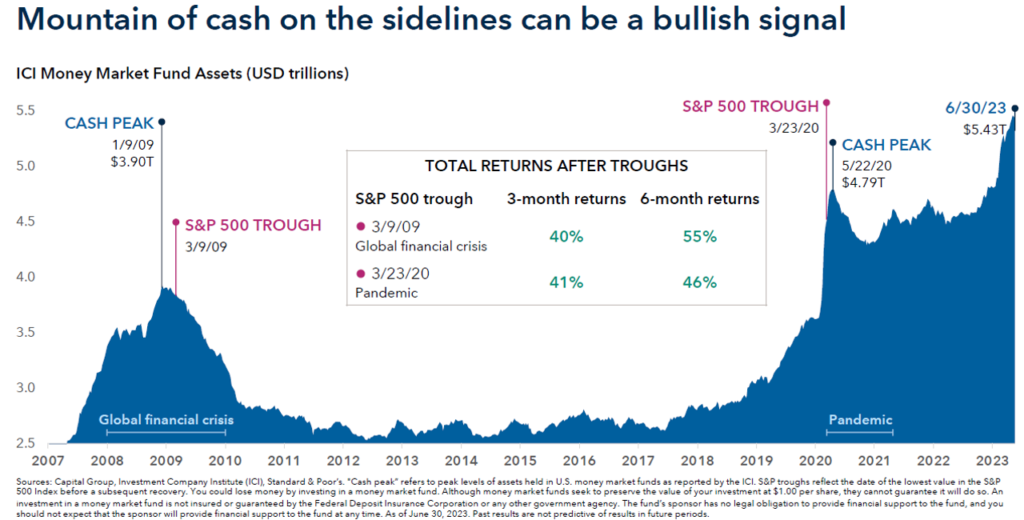

The fact that a monumental magnitude of cash remains on the sidelines buoys our belief that the balance of 2023 will provide a positive backdrop for risk assets. Based on Capital Group’s chart below, entering 2H23 money market fund assets amounted to over $5.4 trillion, or about 14.7% of the recent S&P 500 market cap. Certainly the rapid run-up in short-term interest rates related to the Fed’s actions warrant investors holding heightened cash balances. However, as the Fed nears the end of its tightening cycle we expect the clarity offered for interest rates will lead much of this cash balance back to risk asset and equity markets.

The combination of expectations for increasing market breadth and compelling valuations lead us to favor stocks in the Industrials and Materials sectors vis-à-vis S&P 500 sector weightings. Industrials companies we favor include Lockheed Martin (LMT), Rockwell (ROK), Delta (DAL), Honeywell (HON), Chart Industries (GTLS), and Wesco (WCC). The Materials side we retain in investor accounts Eastman (EMN) and Sociedad de Quimica y Minera (SQM). Outside of these sectors, we recently added Halliburton (HAL) and Tyson (TSN) to client holdings as well.