Pivoting to Preservation for the Balance of 2023

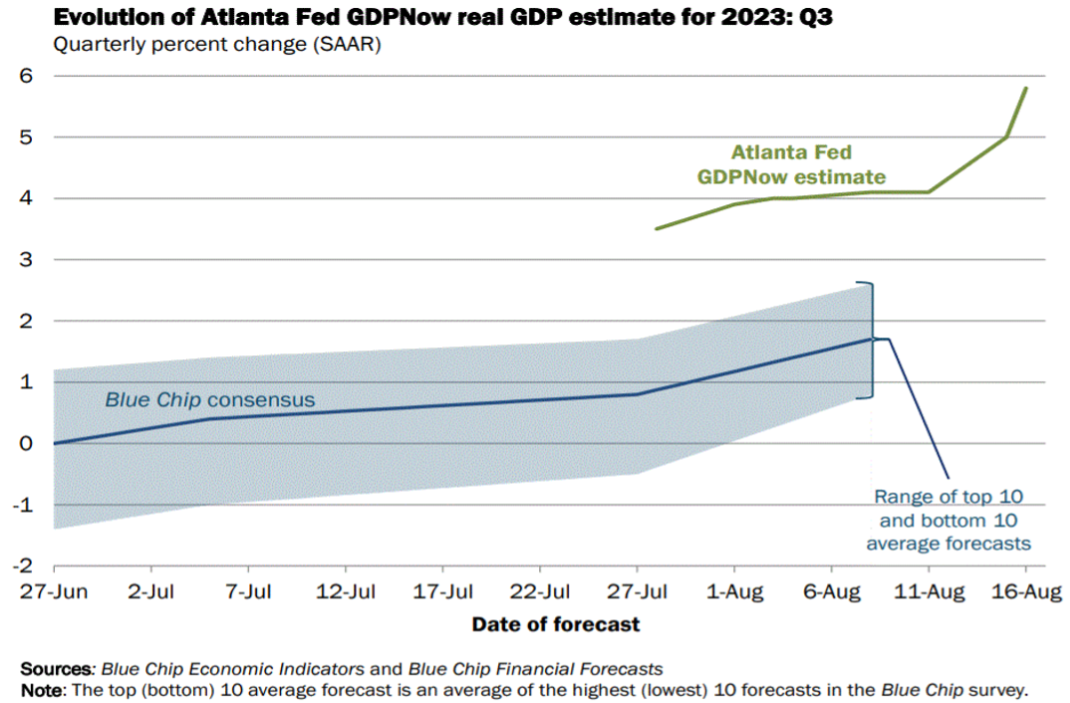

Exiting 2Q23 earnings season Solyco Wealth commenced pivoted client portfolios to take advantage of higher bond yields with less susceptibility to equity volatility and credit risk. While it increasingly appears that the US will forego a recession in 2023 – the Atlanta Fed’s recent GDPNow estimate pointed to 5.8% 3Q23 GDP growth! (see below) – we harbor no expectation that equity markets will reward such lofty economic performance. Rather, we anticipate that any incremental economic strength will be met, at least, with hawkish Fed rhetoric and, more likely, future increases in the Fed Fund Rate. With real yields of 2%+ now available with little duration risk, we choose to increase by a combined 10% short-term Treasury and corporate debt exposure while reducing stock ownership by 10% for our three more aggressive model portfolios.

Exiting 2Q23 earnings season Solyco Wealth commenced pivoted client portfolios to take advantage of higher bond yields with less susceptibility to equity volatility and credit risk. While it increasingly appears that the US will forego a recession in 2023 – the Atlanta Fed’s recent GDPNow estimate pointed to 5.8% 3Q23 GDP growth! (see below) – we harbor no expectation that equity markets will reward such lofty economic performance. Rather, we anticipate that any incremental economic strength will be met, at least, with hawkish Fed rhetoric and, more likely, future increases in the Fed Fund Rate. With real yields of 2%+ now available with little duration risk, we choose to increase by a combined 10% short-term Treasury and corporate debt exposure while reducing stock ownership by 10% for our three more aggressive model portfolios.

Specifically, our allocations to equity range from 25% for our Conservative Model Portfolio to 80% for the Aggressive Model, as shown in the following table. Fixed Income allocations, which we achieve primarily with Exchange Traded Funds, as well as modest exposures to publicly-traded private credit vehicles Ares Capital (ARCC) and Hercules Capital (HTGC), range from 65% in Conservative to now 15% (up from 5%) in Aggressive. We continue to allocate to Cash for two primary reasons:

- We desire to have “dry powder” on hand with which to opportunistically buy equities in the event they offer short-term opportunities we find attractive, and

- Cash, via money market funds, now offers an attractive yield profile as an asset class with minimal risk.

As of last Friday, August 18, 2023, our asset allocation efforts served clients well on both absolute as well as relative basis, as shown below in our performance tables. We at Solyco Wealth are particularly proud of the fact that each of our four model portfolios, if even by the slightest of margins for Conservative, would have generated a positive return since their 9/8/21 reception after our 1% management fee. All of the performance figures below are as of Friday, 8/18/23, presented net of our 1% management fee, and generated using Morningstar Direct statistics.