Yes, a Recession Is Coming; No, It Won’t Be the End of the World for Equity Investing

We at Solyco Wealth anticipate the U.S. entering the most forecasted and discussed recession in economic history some time in 3Q23. One need do little more than scan Bloomberg, CNBC, or any other financial press headlines to discover the all-too-numerous drivers of this impending economic downturn. In short, recessionary drivers encompass various degrees of impacts from the U.S. Federal Reserve escalating the prevailing interest rate environment to counteract inflationary forces that resulted from aggressive acceleration of demand for goods and services, the satisfaction of which labor, logistics, and policy issues complicated, as the country and the world recovered from the worst of the COVID-19 pandemic. Oh yeah, and there was an energy price-spike brought on by Russia invading Ukraine right as that inflation component really started to take root and accelerate. Uhm, I’m forgetting something else, too, that consumers and, thus, economies dislike…bank failures! Thankfully, no one expects anything from the U.S. Congress for another couple months until the Debt Showdown: the fun just never stops!

We at Solyco Wealth anticipate the U.S. entering the most forecasted and discussed recession in economic history some time in 3Q23. One need do little more than scan Bloomberg, CNBC, or any other financial press headlines to discover the all-too-numerous drivers of this impending economic downturn. In short, recessionary drivers encompass various degrees of impacts from the U.S. Federal Reserve escalating the prevailing interest rate environment to counteract inflationary forces that resulted from aggressive acceleration of demand for goods and services, the satisfaction of which labor, logistics, and policy issues complicated, as the country and the world recovered from the worst of the COVID-19 pandemic. Oh yeah, and there was an energy price-spike brought on by Russia invading Ukraine right as that inflation component really started to take root and accelerate. Uhm, I’m forgetting something else, too, that consumers and, thus, economies dislike…bank failures! Thankfully, no one expects anything from the U.S. Congress for another couple months until the Debt Showdown: the fun just never stops!

If Jerome Powell and Team Fed could solve all of the above with interest rate policy, they should be the subjects of the next Marvel superhero movie! Soft landing? I think we’ve already experienced more than a few bumps. Anyone failing to anticipate a few things going “thud” navigating out of lockdowns and re-starts should have exited this economy and returned to graduate school or run for public office.

Anyway, while recessionary impacts may be imminent, we do not necessarily think this translates to a repeat of 2022 for risk asset markets. The fact that returns stunk for pretty much everything but oil stocks last year defines the biggest driver of this opinion: most markets already priced in expectations for crummy 2023 performance last year! This leads us to another potential source of sunshine: asset markets remain forward-looking. Based on this simple forward-looking hypothesis we would not be surprised to see equity markets trade flat to 10% lower over the next six months as investors parse out the probable magnitude (small, we think) and duration (short, we expect) of this 2023 recession. To take advantage of this expectation Solyco Wealth commenced to generate cash in client accounts earlier this month so as to continue dollar-cost averaging into the securities we most desire to own. When appropriate, we also engaged in writing covered calls against core equity positions in response to upward volatility spikes.

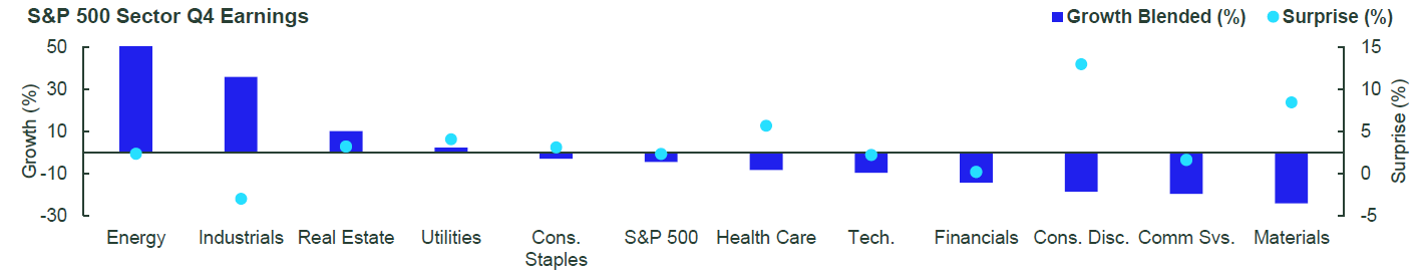

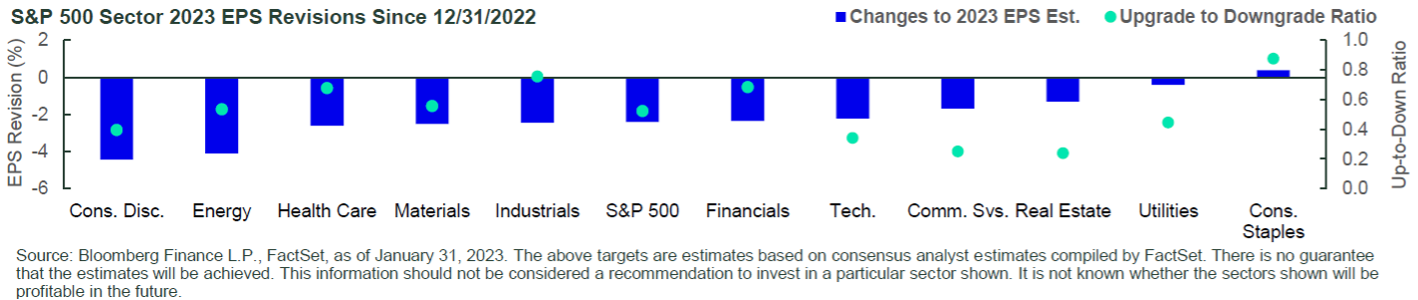

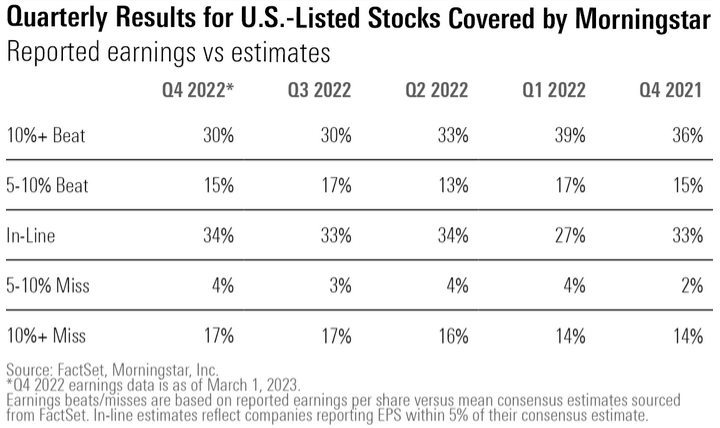

At this point doomsayers may be shaking their heads and wondering where in the world an intelligent investor could possibly derive positive market views. “It’s a recession!” they exclaim. We calmly agree, but append that exclamation with the fact that many people anticipated this recession and, thus, adjusted for its likelihood some time ago. In support of this claim, we present a several graphs below from Doubleline and Bloomberg and Morningstar describing the magnitude of 4Q22 earnings surprises, 2023 earnings revisions, and some context for 4Q22’s earnings performances.

Certainly, we would not be surprised to see the magnitude of revisions in the graph above accelerate with 1Q23 reporting season. In fact, we would find it shocking if company managements chose not to take the opportunity to lower the bar again for 2023 earnings expectations given the negative economic environment and its well-stated and documented challenges. The other side of this “lowering the bar” process, however, easily could be a priming of the pump for more robust, recovery-like expectations for 2024. Again, markets always look forward.

While consumer spending and attitudes appear to remain comparatively resilient, a number of economic components indicate declining inflation. Compounding the impacts of higher interest rates, tighter credit conditions resulting from the collapse of Silicon Valley Bank and Signature Bank will continue to slow economic activity as well. The following table also show that the costs of shelter, which compose 40% of the Consumer Price Index, fell earlier this year, a phenomenon that almost certainly will continue with tighter credit markets.

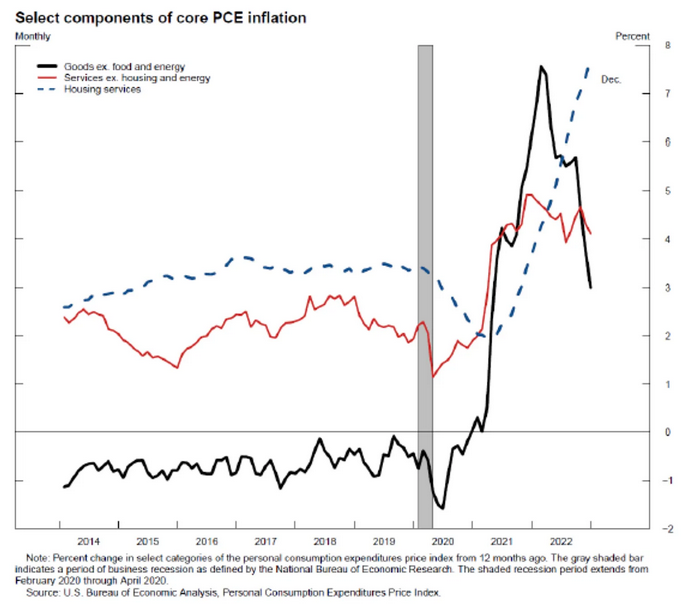

Goods inflations, as relayed in the chart below, started declining months ago. Recently, drops in Services costs joined this decline in Goods prices. The China restart could create a short-term bump higher in Goods prices, but we anticipate ongoing declines in Shelter and Services costs more than compensating for it. Bottom-lining it: at least a little good on the inflation front is starting to materialize in 2023 to offset much of what was so bad in 2022.

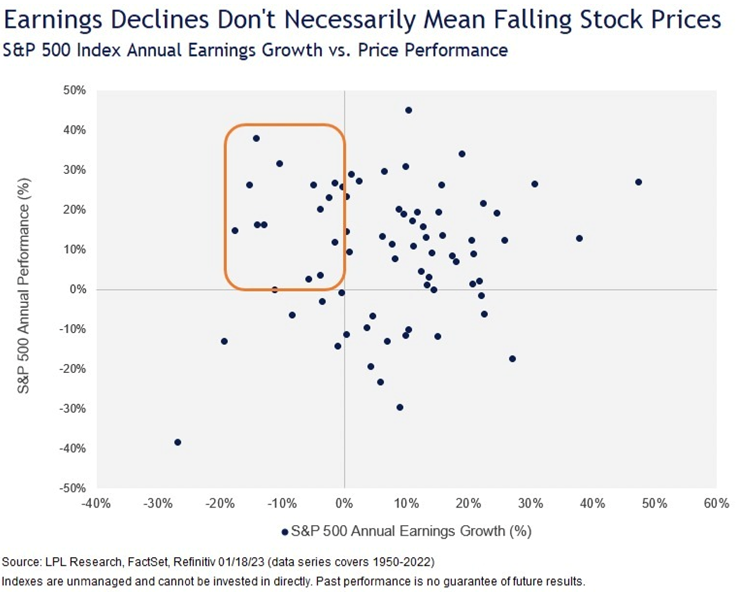

We conclude with the fact that declining earnings do not always foretell falling equity prices. As shown in the following scattergram pilfered from LPL, more than a few times over the past 70 years the S&P 500 rose despite declining earnings estimates. So you’re saying there’s a chance…