Still Work to Do for this Bear-Market Rally to Morph into a New Bull Market

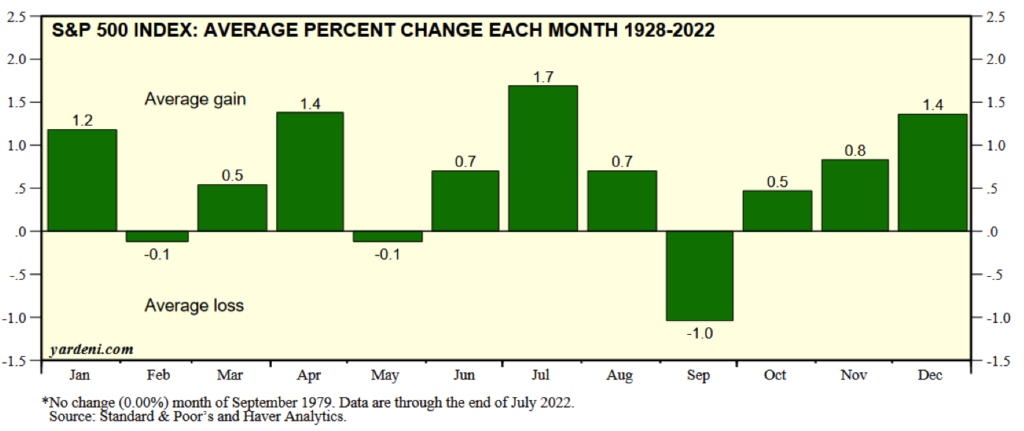

Anything but a consensus view exists with respect to the probable future direction for stocks and bonds. To be sure, the latest two-month advance in risk assets caught more than a few bears by surprise. Short-covering almost certainly added frothiness to the July-August gains, but a 50% retracement of earlier 2022 losses provides a fairly solid base for positive momentum. For the lucky few that covered their short positions in the mid-June downdraft, though, post-2Q22 earnings season may offer an opportune time to re-short their most disdained stocks. After all, as the chart below from Yardeni Research shows, September historically provides the worst month for the stock market. What’s an investor to make of this environment?

Anything but a consensus view exists with respect to the probable future direction for stocks and bonds. To be sure, the latest two-month advance in risk assets caught more than a few bears by surprise. Short-covering almost certainly added frothiness to the July-August gains, but a 50% retracement of earlier 2022 losses provides a fairly solid base for positive momentum. For the lucky few that covered their short positions in the mid-June downdraft, though, post-2Q22 earnings season may offer an opportune time to re-short their most disdained stocks. After all, as the chart below from Yardeni Research shows, September historically provides the worst month for the stock market. What’s an investor to make of this environment?

Solyco Wealth continues to “ride the fence” with respect to choosing sides in this bear-bull tug-o-war. Starting six weeks ago we commenced over-writing much of our portfolios with covered calls that, generally, were at-the-money to +10% out of the money with respect to the underlying strike price. With early positive market momentum offering premiums of 1% to 2% for contracts of one month or less in duration, the risk-reward proposition appeared very attractive to us. In our view the option market still offers attractive risk management opportunities vis-à-vis company-specific medium- to long-term valuation forecasts and prevailing market conditions and, as a result, we continue to roll over most of these covered-call positions.

As we roll these options contracts, though, we remain hyper-cognizant of several key conditions that might signal conversion of this bear-market rally into a full-fledged bull market. We draw heavily on work performed by Ned Davis Research for this monitoring function. Key metrics include:

- 90% of Russell 3000 stocks trading above their 10-day moving average (wide breadth of short-term positive momentum)

- Advancing stocks outpacing declining stocks for the S&P 500 by a 2-to-1 margin for at least a 10-day period (persistent positive momentum)

- Over 50% of Russell S&P 500 stocks setting new 20-day highs (ongoing duration of the move higher)

The strength of the move higher in a bear-market rally matters very little vis-à-vis the breadth and duration of the move higher. Markets threw investors more than a few head-fakes through the years with several past bear-market rallies in excess of 25%. The median gain for these largest rallies was 11.5%, according to Ned Davis Research, but with a median length of only 39 days before they fizzled.

As we view the other side of this fence we straddle, we also remain on the lookout for several phenomena crucial to gauging the probability of a swift and severe downturn. In our view downside data drivers likely will prove to be of a more fundamental nature than the obviously more technical characteristics we monitor for ongoing upside for markets:

- Employment figures quickly deteriorating with resulting weakness in consumer sentiment and spending materializing

- Inflation expectations re-accelerating to the upside which would imply the Fed will hike rates higher for longer

- Corporate margins rapidly deteriorating faster than expectations due to labor, logistics, or raw materials pricing pressures (unlikely revenues decline in an inflationary environment)

Regardless of whether one views asset markets as in bear or bull phases, we counsel clients and investors to remain aware of the fact that attractive investment opportunities exist in all types of markets as well as through all phases of these markets. One need look no further than the 2022 price performances for the Energy and Utilities sectors and many of their component companies for evidence of this, as well as for several insurers and manufacturers.

Importantly, we maintain fundamental valuation discipline, particularly in frothy environments like we currently experience, and exit positions that look rich irrespective of the overall trend for risk assets. Notably, 11 of the 53 positions (20.7%) held across Solyco Wealth’s four model portfolios recently traded within 10% of our estimated values. We remain comfortable maintaining cash balances in excess of 10% in investment environments as volatile as that of 2022.