While Inflation Might Not Be Transitory, It May Be Rolling

We anticipate inflationary conditions above the Fed’s 2% target persisting across various sectors of the economy for at least the balance of 2022. However, we expect the extremes of durable goods, energy, and foodstuffs inflation realized early in 2022 soon will give way to services inflation. As the rate of Omicron infections declines and consumers revisit all things services – restaurants, gyms, theaters, travel and hospitality – the increased labor intensity of these sectors probably will result in the goods inflation rolling over to the services sector.

We anticipate inflationary conditions above the Fed’s 2% target persisting across various sectors of the economy for at least the balance of 2022. However, we expect the extremes of durable goods, energy, and foodstuffs inflation realized early in 2022 soon will give way to services inflation. As the rate of Omicron infections declines and consumers revisit all things services – restaurants, gyms, theaters, travel and hospitality – the increased labor intensity of these sectors probably will result in the goods inflation rolling over to the services sector.

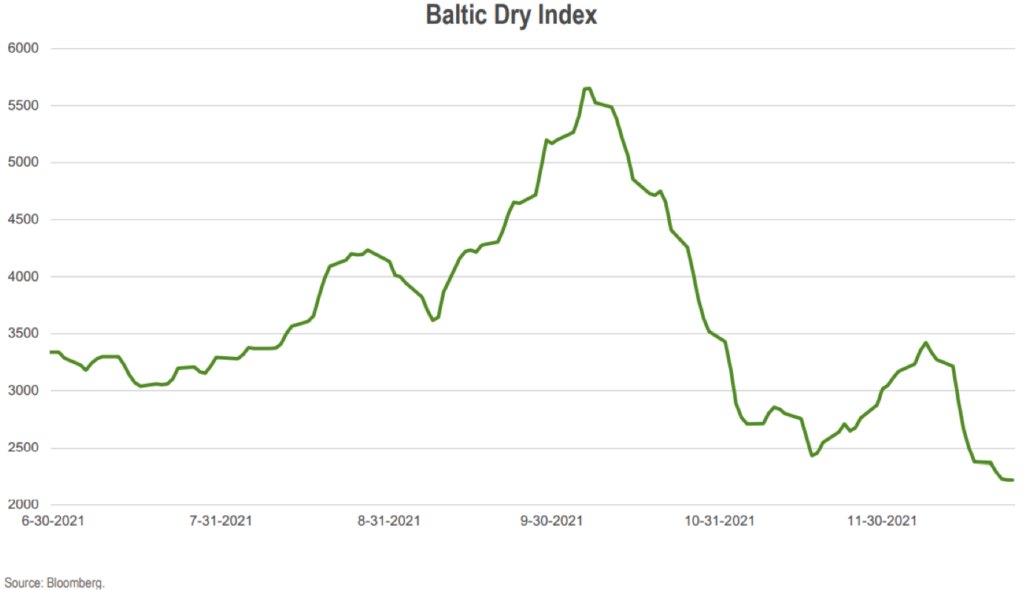

As shown in the chart below, the Baltic Dry Index, which reflects the cost to ship dry bulk goods such as iron ore, coal and grains, declined precipitously over the past four months from its extreme 3Q21 peak. In fact, this Index recently moved ~35% below its 2Q21 level. Notably, while the Baltic Dry Index declined over the past four months, backlogs of waiting ships continued to wait to be unloaded at offshore U.S. ports. As those goods make their way into inventories and onto store shelves, representative prices likely decline in response to increased goods availability and reduced goods scarcity.

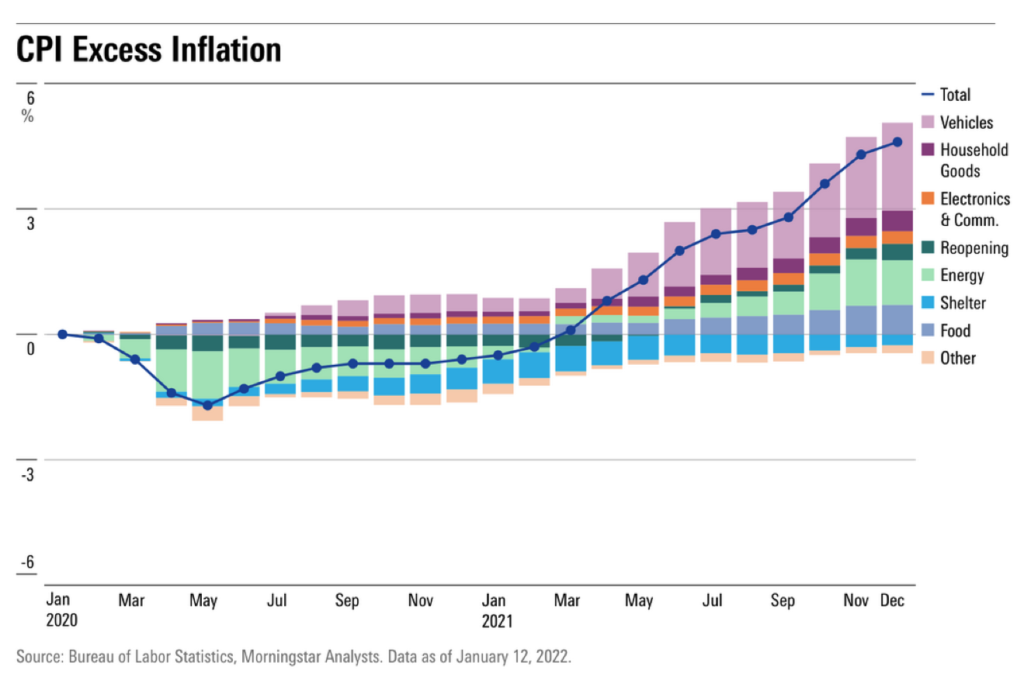

The prospects of increased goods availability at prospectively lower prices in combination with boosted activity levels resulting from warmer weather and fewer COVID infections, likely translates to increased services demand. Notably, however, the services sector offers far more substitutes than do the Energy and Automotive sectors, the two largest drivers of excess inflation, per the following graph from Morningstar.

If our rolling inflation theory proves to be correct over the next 6 to 12 months, we anticipate fewer actions will be required of the Fed to reign in inflation. As compared to the recent discussions of as many as seven Fed rate hikes over the next year, in an environment of rolling inflation the Fed likely achieves its inflation goals by achieving neutrality with its open market operations and three rate hikes. Under this scenario we expect much reduced market volatility and more accommodating environments for risk assets as compared to that with which we started 2022.