Curiosier and Curiosier…Equity Markets May Get Even Sillier

The yo-yo path on which assets markets traded in 2022 finally bounced to the upside in July and early August only to traverse their downward trajectory – again – later in August and early September. Of late, Fed comments from Brainerd and Powell reinvigorated upside drivers with little more than recognition that increases in the Fed Funds Rate could push the U.S. economy into a recession. Sometimes knowing the problems half the battle…

The yo-yo path on which assets markets traded in 2022 finally bounced to the upside in July and early August only to traverse their downward trajectory – again – later in August and early September. Of late, Fed comments from Brainerd and Powell reinvigorated upside drivers with little more than recognition that increases in the Fed Funds Rate could push the U.S. economy into a recession. Sometimes knowing the problems half the battle…

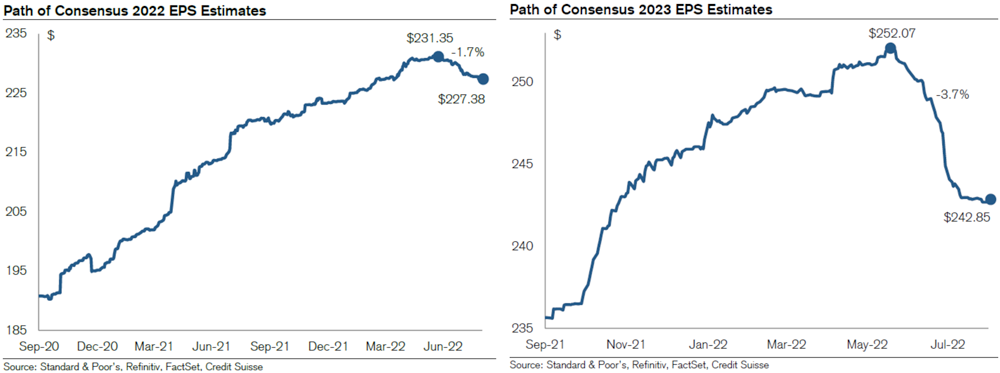

Naysayers through the Late Summer 2022 bump in markets (bear market rally???) pointed to not only the probability, but the necessity for earnings forecasts to decline. Revisions, as shown in the following graphs from CS First Boston, commenced prior to 2Q22 earnings season as analysts updated estimates for the impending earnings announcements. Those forecasts for 2022, as shown in the left graph below, proved to be comparatively miniscule. The revisions to 2023, however, as conveyed in the graph below on the right, amounted to more than twice the magnitude of the revisions to 2022 earnings expectations.

We advise clients and investors look out for a few things as they parse out how Fed actions, economic activities, analyst earnings revisions, and company communications might impact asset markets:

- Ongoing volatility that cuts in both directions, downward and upward, offering opportunities to:

- Sell the peaks and buy the valleys,

- Utilize options, if sufficient comfort and knowledge exists, to benefit from this volatility,

- Exhibit confidence in assets owned and choose not to pay attention to the volatility.

- “Sandbagging” from proactive company management teams that opportunistically utilize episodes of low and falling investor expectations to set a low bar which they subsequently clear amidst…

- Unforeseen margin resilience brought on by unannounced

- Hiring freezes,

- Declining raw materials prices, and/or

- Skinnier executive bonuses (I’m joking here)

- Higher sales incited by increased promotions and/or advertising

- Favorably managing inventories and other accounts subject to accrual accounting.

- Unforeseen margin resilience brought on by unannounced

- Straight-up gaming of the system to reduce expectations in a favorable environment.

The most effective way we found to manage through periods like this are to remain confident in assets owned and frequently to reinforce the reasons to own those assets. Distinctions in the drivers of reduced expectations matter in that structural issues like the loss of a major contract or significant declines in product/service quality may linger for much longer than more episodic challenges such as higher raw materials or labor expenses or reduced access to transportation and logistics solutions.